🌻 Be Honest With Yourself | Series Vol. 2

Are You Financially Secure — or Just Getting By?

When we talk about honesty, it’s easy to focus on emotions, relationships, or self-growth.

But one of the most difficult truths to face is the state of our financial stability — the quiet foundation that determines how safe, supported, and secure we really are.

Have you ever sat down and asked yourself, “If something unexpected happened… how long could I stay afloat?”

For many, that question brings both clarity and discomfort. But awareness is power — and being honest with yourself about your finances is one of the strongest acts of self-care. 🌻

💰 The Reality Check

Most financial experts recommend keeping three to six months of essential living expenses in a separate emergency fund — enough to create a cushion between stability and crisis.

To calculate your personal savings goal:

1️⃣ List your essential expenses — housing, utilities, groceries, transportation, insurance, and debt payments.

2️⃣ Multiply your total by 3, 6, or 9, depending on your lifestyle:

3 months → Good starting point for individuals with steady income. 6 months → A safer cushion for families or homeowners. 9 months → Ideal for freelancers or those with fluctuating income.

It’s not about perfection — it’s about preparation.

📊 Why It Matters

A study by Self Financial found that Americans with less than $400 in savings were, on average, just 118 days away from homelessness if they lost their job.

That number is haunting — but it’s also a wake-up call.

Your ability to stay housed doesn’t depend on luck; it depends on planning, consistency, and community support.

🏡 Key Factors That Affect Security

Income: Consistent income keeps you grounded. Housing costs: Spending more than 30% of your income on rent or mortgage increases risk. Location: Cost of living varies dramatically — Seattle isn’t Oklahoma. Support system: Friends, family, and local programs can be lifelines during crisis.

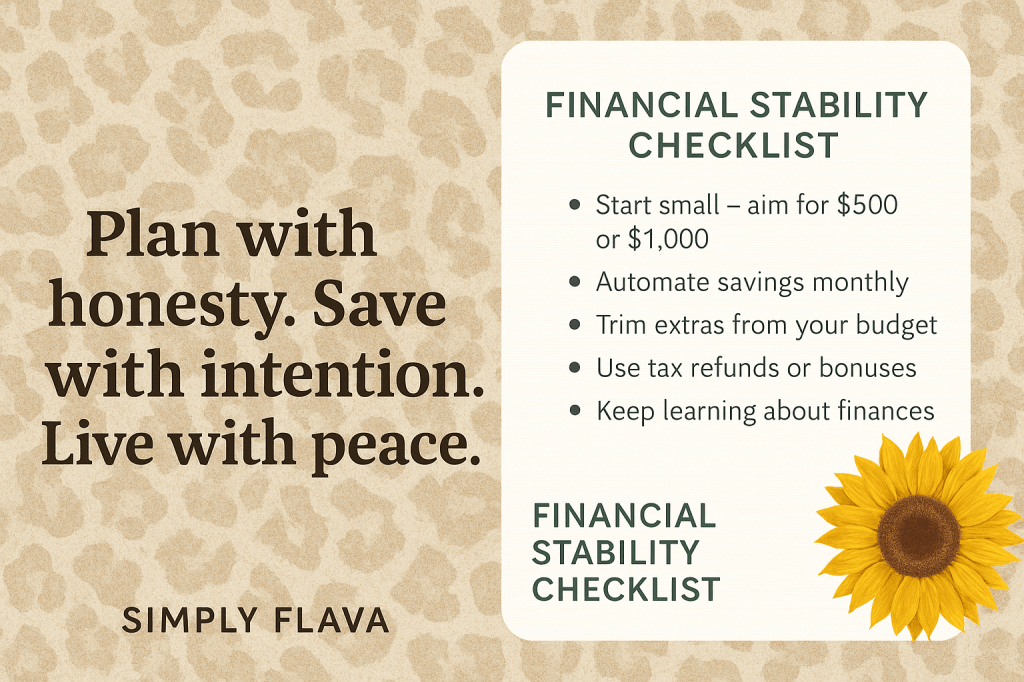

🌱 Steps to Build Your Emergency Fund

Start small. Aim for $500 or $1,000 and build from there. Automate savings. Let small amounts move to a separate account automatically. Trim extras. Shift money from take-out, subscriptions, or impulse buys into savings. Use windfalls wisely. Tax refunds, bonuses, or overtime pay can grow your cushion. Keep learning. Building financial literacy is an act of empowerment — not fear.

🌻 Simply Flava Reflection

“Being honest with yourself isn’t always comfortable — but it’s necessary. Security isn’t just about the roof over your head; it’s about knowing you’ve built a soft place to land if life shifts.”

This isn’t about fear.

It’s about preparation, peace, and empowerment — the kind that lets you breathe easier when the unexpected happens.